No buy year challenge is gaining popularity as more people confront debt, clutter, and the overwhelming cycle of consumerism. If you’re curious about whether a no-buy challenge can truly save money, improve wellbeing, or help you break shopping habits for good, this guide shows the real results, the concrete steps, and the setbacks nobody talks about.

Key Takeaways

- No buy year challenges can lead to dramatic debt reduction and savings—some individuals saved up to $50,000 in a year.

- Common setbacks include social pressure, temptation, unexpected expenses, and lack of family adaptation strategies.

- Lasting behavioral change is possible, but only with strong planning and realistic expectations for obstacles.

- The Core Concept: What is a No Buy Year Challenge?

- Step-by-Step Guide: How to Start (and Survive) a No-Buy Year

- Advanced Analysis & Common Pitfalls

- Conclusion

- FAQ

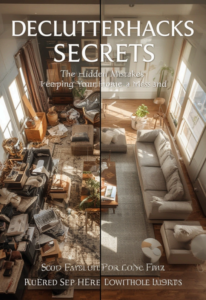

The Core Concept: What is a No Buy Year Challenge?

A no buy year challenge is a 12-month commitment to stop purchasing non-essential items. Instead of spending on clothes, gadgets, décor, or anything outside planned essentials and true needs, participants audit their habits to break addictive cycles and regain financial control. This method emerged from minimalist movements and now serves as a protest against overconsumption and mounting debt, with social media fueling both interest and accountability. The goal is not just to save money but to rethink long-term consumption habits, reduce clutter, and improve emotional wellbeing.

During 2023 to 2025, shifts in shopping patterns—especially among young Americans—have led to record debt and shopping addiction, much of it attributed to pandemic habits and social-driven spending. Recent studies confirm many use the challenge to dig out from under critical debt and to protest exploitative corporate practices.

But it’s not just financial. Many cite mental exhaustion, cluttered homes, and a desire to “reset” as main motivators. Whether undertaken for economic, ethical, or emotional reasons, the no buy year is a rising movement among those tired of letting money and stuff control their choices.

Step-by-Step Guide: How to Start (and Survive) a No-Buy Year

Most no buy year attempts fail without a game plan. Here’s how to actually do it:

-

Set Clear Rules

Decide which purchases are strictly allowed (e.g., food, medicines, true essentials). List what’s absolutely banned, and write down exceptions if needed, such as gifts or urgent replacements. Defining the rules ahead prevents “creative justifying” in weak moments. -

Track Every Purchase

Use a notebook, spreadsheet, or a free app—whatever sticks for you—to log each expense. Categorize by necessity and record feelings. This builds awareness, especially during the first 60 days. -

Prep Your Environment

Hide shopping apps, unsubscribe from store emails, and tell close friends and family about your challenge. Social pressure and easy access are major saboteurs. -

Use What You Have

For home decluttering, resist the urge to buy storage products. Instead, sort, donate, or repurpose what’s already in your home. Check out these three simple declutter hacks for actionable methods. -

Set Up Accountability

Share progress on social channels, join a challenge group, or ask a friend to check in regularly. Over 40% of participants succeed only when they go public. -

Plan for Setbacks

Life happens—unexpected bills or events can break momentum. Decide in advance how you’ll handle repairs, gifts, or travel. -

Declutter Without Buying

Tidy your space with zero spending. Start with the cobwebbing method to tackle sentimental clutter, a major emotional barrier. -

Document Your Wins (and Fails)

Recording both successes and relapses will help you spot patterns—and avoid future slips.

If you struggle to get started, digital tools can help. AI-powered apps now act as personal organizers, making it easier to track spending, plot decluttering sprints, and stay focused—learn more about using AI to declutter here.

Planning to store away seasonal gear or streamline your closet? Rethink the need for extra products by reusing what you already have, but if space becomes a true problem, consider budget-friendly solutions like 90L closet organizers after the challenge.

Advanced Analysis & Common Pitfalls

Not every no buy year challenge works out as planned. Here’s what commonly trips people up, according to recent reports and testimonials:

- Social Pressure: Friends and family may undermine your goals, whether through subtle jokes or invitations to shop “for fun.” The lack of family adaptation strategies is a major source of relapse, especially in households with kids.

- Spending “Substitutions”: Some replace shopping for clothes with splurging on experiences or binge-eating out, which can simply shift—not eliminate—over-spending.

- Unexpected Expenses: Car repairs, surprise gifts, or necessary tech updates can force users off-plan. It’s vital to plan for these “emergencies” within your defined rules.

- Motivation Drop-Off: Initial excitement can fade fast. About half of participants only last 1 to 3 months without active social support or public accountability. Some report backlash for perceived virtue-signaling or for highlighting overconsumption online [source].

- Culture of Quick Consumption: Social media ads and “doom spending” behavior, fueled by economic anxiety, can trigger impulse buys as a coping mechanism [source].

- Deceptive Decluttering: The urge to “organize” by buying new bins or containers sabotages actual decluttering. Evidence suggests that decluttering with zero spending achieves better long-term results. If you’re stuck in nostalgia, try methods designed for letting go, such as the cobwebbing method.

| Case Study | Savings / Debt Reduction | Reported Pitfalls | Mental Health Effect |

|---|---|---|---|

| Florida Content Creator | $50,000 in credit card debt paid off in 1 year | Initial social pushback, temptation with online ads | Increased confidence & reduced anxiety |

| Survival Debt Payoff | $30,895.05 in 488 days | Struggled with unforeseen bills; motivation dips after 6 months | Sense of relief and empowerment |

| Joy Nelson (Minimalist) | N/A (Focus on behavior, not savings) | Loneliness, occasional judgment from peers | Mental health improvement, less stress about shopping |

There is very little published data about long-term effects, mental health post-challenge, or sustainable spending. Most articles highlight individual savings stories, not broad averages or true behavioral change. If you’re considering this challenge for your family, there’s a notable lack of strategies tailored to group settings. Many adapt by engaging younger household members in the decluttering process, mimicking trends like fridgescaping to create a sense of newness without buying anything.

Conclusion

The no buy year challenge isn’t a fix-all. It’s realistic to expect slip-ups, frustration, and moments where you question the rules. However, most who stick with it experience dramatic savings, reduced anxiety, and a new outlook on what brings true satisfaction—as shown by those who paid off more than $50,000 and broke shopping addictions. If you want a practical way to cut clutter, control debt, and build lasting change, the no buy year challenge is worth considering. Start with small, realistic steps and evolve your approach as needed. Ready to challenge your spending habits? Take the first inventory of your home today—and let us know how your first month goes.

FAQ

What are the typical “allowed” purchases during a no buy year challenge?

Most people permit only genuine essentials such as groceries, household supplies, and necessary medications. Some add wiggle room for travel or urgent replacement items, but all discretionary spending (like clothes, gadgets, or décor) is banned.

How much money can you expect to save in a no buy year?

Savings vary, but case studies show individuals saved $30,000 to $50,000 in one year, mostly by targeting unnecessary daily purchases and credit-fueled spending. There are no universal averages, as success depends on your previous spending habits.

Is it possible to declutter effectively without buying new organizing products?

Yes. Many successful participants use creative DIY solutions like repurposing jars, boxes, or baskets rather than buying new bins or shelves. Check out step-by-step declutter guides for practical approaches.

What are the most common reasons for failing a no buy year challenge?

The most cited reasons are social invitations to shop, emotional spending after stressful triggers, unforeseen real expenses, and lack of buy-in from family members. Motivation tends to fade after the first few months without accountability.

How can you involve your family in the no buy year challenge?

Explain the rules clearly, set fun decluttering days, and try turning home organization projects into collaborative games. Use trending ideas like fridgescaping to foster teamwork and creativity—without new purchases.

[…] proven organization aids, digital tools, and building mindful acquisition habits—such as the no buy year challenge for long-term clutter […]

[…] method thrives on principles similar to the no buy year challenge and one in, one out rule, both of which focus on mindful acquisition and purposeful decluttering, […]